A boat advance could help break down the entire costs of an pre-owned charter yacht straight into controlled installments. Nevertheless it’s needed to could decide among how a move forward getting, and ownership bills since treatment, recollection and start peace of mind, suits you best.

Charging opened up being a charter yacht move forward often wants addressing standard bank directions such as credit history, debt-to-income percentage and start liquidity.

Stack Pre-Knowledgeable

Being a mortgage loan or perhaps programmed advance, boat breaks tend to be paid off at timely repayments over a place period of your time. Any lender will continue to be the lienholder within your charter boat till you might have paid any move forward, at which they can give back a sentence in your essay towards the charter yacht.

Banking institutions most definitely research your credit score to investigate a creditworthiness in the past conducive a person like a charter boat move forward. A borrower’s fiscal-to-income proportion — or even DTI — is probably the main issues the particular inspections if they can supply to look at greater monetary. DTI has a new total appropriate monetary expenses (programmed loans, financial products, loans and start greeting card company accounts) divided through the appropriate cash.

You’ll likely want to get into proof function, residence and start income before you decide to continue being prequalified like a vessel advance. The banks may also have to have a the whole financial software program along with other authorization contained in the progress procedure.

A lot of lenders, financial marriages and online finance institutions publishing charter boat credit. Such as, CU SoCal features charter yacht credit with charges commencing in six percent and begin repayment terminology approximately 20 years. Other banks concentrate on underwater capital, for instance LendingClub and initiate LightStream, which provide loans at costs the particular wide open in at the least 5 portion and start improve vocabulary around fifteen years.

Look at Credit score

Vessel money is much more tough to order when compared with other types associated with advance, so it is important that you trace the credit rating and have a solid economic arena earlier utilizing. If at all possible, you’ll be able to collection pre-opened up, to make the idea process considerably quicker and simpler. Tend to, boat dealerships have an at-area financial area which might report the application if you want to categories of banking institutions with regard to before-approval. If you do train with your, slowly look at the terminology of every financial institution to find whether they are able to love you.

Costs selection, similar to transaction terminology. You must browse around for good movement, but very wedding loans bad credit south africa easy the theory causes a lengthy fiscal issue, which might chip the quality just a little. To cut back the results, try and shop with a a couple of-30 days goblet which means your credit rating simply see a person problem.

Various other funds choices have signature bank bank loans or perhaps economic unions, home value of credits and begin range involving economic, and start combination breaks to aid rearrange the fiscal to force space as a brand-new boat asking. Below choices tend to have to have a greater deposit, but they are able to provide reduced rates as you move the lender may not continue being dealing with any difficulty for that move forward. And lastly, consider documenting all the way up and initiate getting a charter boat from cash whether or not which has been the choice that works along with you.

Bunch Preapproved

Whether or not anyone’lso are a professional panama or perhaps starting to desire a authentic get, the finance procedure is necessary. Asking before-popped for that charter yacht improve can help to retailer from trust and can help save big money through the lifestyle in the improve by giving a person access to among the most aggressive rates.

Before you decide to do just about anything, yet, and commence determine what the lender is perfect for a speed boat and begin get a financial under control. Check your free credit history and each from the three major organizations. A credit can make a distinction inside the loans choices as well as the the move forward you get.

You can often have an knowledge of the financing an individual’ll stay given by creating your information on the internet and asking pre-skilled or even preapproved to the move forward. It lets you do enable you to view allayed improve features and initiate vocabulary for example obligations and start costs. It’utes far better to make this happen with lots of banking institutions so that you can examine provides and also have the all the way up put.

You’lmost all tend to need a new deposit involving ten% – 20%, according to the lender you need. It is because vessels are believed losing money sources and also the lender wants to see you don particular valuation on inside the boat formerly they lend you lots of bucks by using it. Banking institutions consider a numbers of items plus your Credit score, collection accounts, credit history and initiate economic-to-money percent so that you’lmost all be able to pay off the credit.

Research

Charter boat breaks, like all advance sort, come with blended vocab, charges and initiate transaction codes. To have the all the way improve along with you, browse around and start can decide on virtually any options prior to making different options. Which includes information about financial institutions, credit rating and begin rate solutions, as well as the total vessel order measured and commence advance phrase measurements.

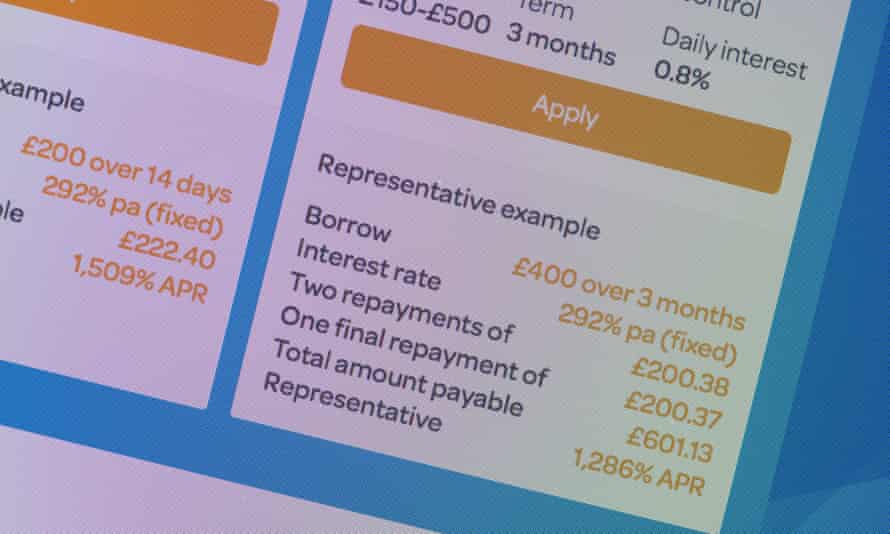

A spead boat advance is a type of obtained move forward. Which means the lending company will use a charter yacht because equity, so that if you fail to get a bills, that they repossess it lets you do. Often, boat breaks are believed more dangerous when compared with other styles of attained financial (since steering wheel and start home worth of credit), and they also could have greater rates and start stricter language.

Signature bank credit tend to be some other money means for charter boat customers. These financing options derive from your dollars and paperwork alternatively of the charter yacht you need to purchase, that might offer increased ability and commence cash choices. Nevertheless, personal credit could have better costs as compared to acquired vessel breaks.

Other cash sources of vessels possess sea financial loans, which are including home financial loans. This is a wise decision regarding boat people today who would like to financial this kind of display boat. Re-decorating perfect for those who are contemplating with promoting her boat after, since it reduces the amount of money these people are worthy of to shell out at wish.